Published on November 28, 2024

Building a Balanced Cryptocurrency Portfolio: Diversification Strategies and Risk Management

The cryptocurrency market presents unique opportunities and challenges for investors seeking to build wealth in the digital age. Unlike traditional financial markets, the crypto ecosystem operates continuously, exhibits high volatility, and encompasses thousands of distinct digital assets with varying characteristics and use cases. Understanding how to construct a balanced portfolio that manages risk while capturing growth potential is essential for anyone serious about participating in this emerging asset class.

Understanding Market Capitalization Categories

Cryptocurrencies can be categorized by market capitalization, which represents the total value of all coins in circulation. This classification helps investors understand the relative size, stability, and risk profile of different digital assets.

Large-Cap Cryptocurrencies

Large-cap cryptocurrencies typically have market capitalizations exceeding $10 billion and represent the most established projects in the space. Bitcoin and Ethereum dominate this category, offering relative stability compared to smaller assets. These digital currencies have demonstrated resilience through multiple market cycles, possess substantial liquidity, and benefit from widespread recognition and adoption.

Large-cap assets serve as portfolio anchors, providing exposure to the cryptocurrency market while moderating overall volatility. Their established networks, proven security records, and institutional adoption make them suitable core holdings for most investors. However, their size also means they may offer lower percentage gains compared to smaller, emerging projects during bull markets.

Mid-Cap Cryptocurrencies

Mid-cap cryptocurrencies generally range from $1 billion to $10 billion in market capitalization. This category includes established projects with proven use cases but room for significant growth. Examples might include layer-one blockchain platforms, decentralized finance protocols, and infrastructure projects that have gained traction but haven't yet reached the scale of market leaders.

Mid-cap assets offer a balance between the stability of large-caps and the growth potential of small-caps. They typically have functional products, active development teams, and growing user bases. Investors should evaluate these projects based on their technological innovation, competitive positioning, partnership networks, and ability to capture market share within their specific niches.

Small-Cap and Emerging Projects

Small-cap cryptocurrencies, with market capitalizations below $1 billion, represent the highest risk and highest potential reward segment of the market. These projects may be in early development stages, serving niche markets, or introducing novel technological approaches. While some small-cap projects will achieve substantial growth, many will fail to gain traction or maintain relevance.

Investing in small-cap cryptocurrencies requires thorough research, understanding of the project's fundamentals, and acceptance of significant volatility. These assets should typically represent a smaller portion of a diversified portfolio, allocated only with capital that investors can afford to lose entirely.

Diversification Strategies for Digital Assets

Diversification remains a fundamental principle of portfolio construction, helping to reduce unsystematic risk while maintaining exposure to potential gains. In cryptocurrency markets, diversification takes several forms beyond simply holding multiple coins.

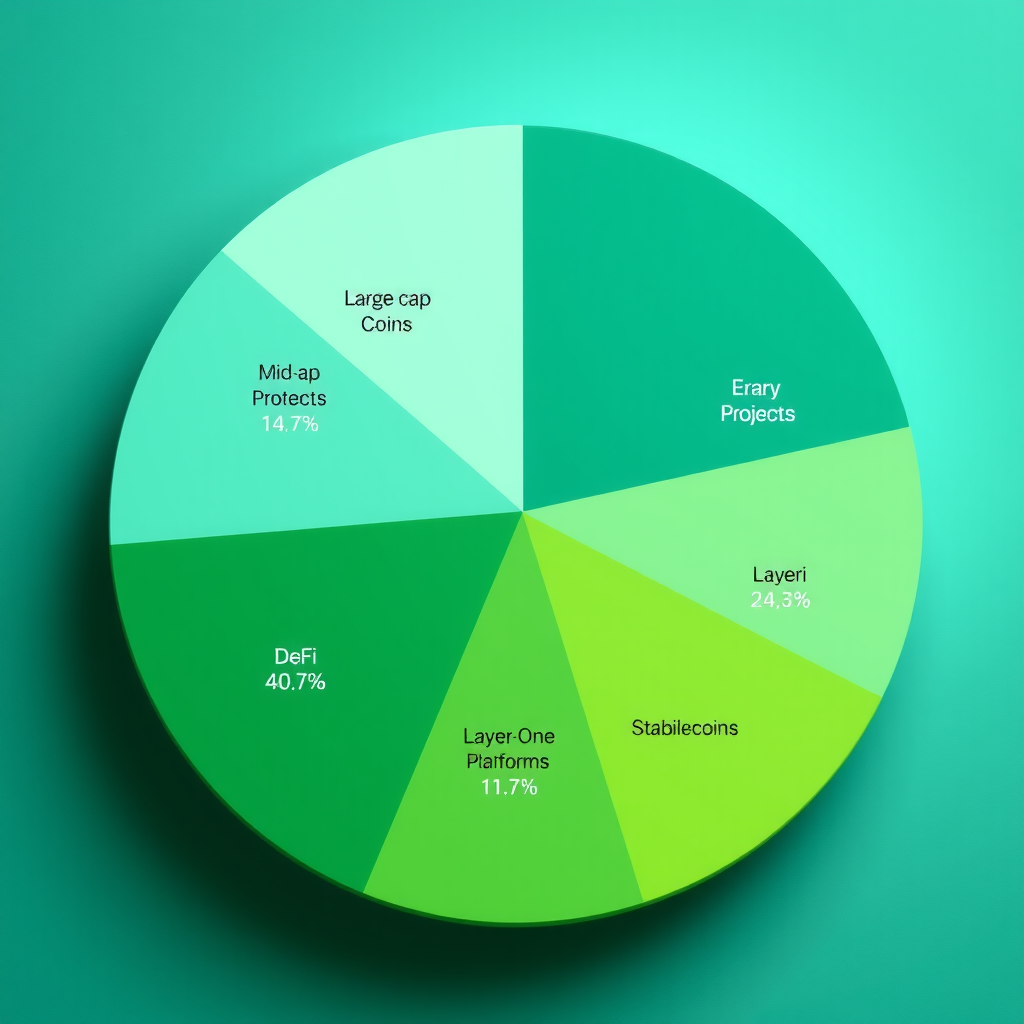

Sector-Based Diversification

The cryptocurrency ecosystem encompasses various sectors, each serving different purposes and addressing distinct market needs. A well-diversified portfolio might include exposure to:

- Store of Value Assets:Digital currencies designed primarily to preserve and transfer value, with Bitcoin being the predominant example.

- Smart Contract Platforms:Blockchain networks that enable programmable transactions and decentralized applications, such as Ethereum and competing layer-one solutions.

- Decentralized Finance (DeFi) Protocols:Projects providing financial services like lending, borrowing, and trading without traditional intermediaries.

- Infrastructure and Scaling Solutions:Technologies that improve blockchain performance, interoperability, or user experience.

- Utility Tokens:Assets that provide access to specific platforms, services, or ecosystems.

By allocating capital across different sectors, investors reduce the impact of sector-specific challenges while positioning themselves to benefit from growth in multiple areas of the cryptocurrency market.

Geographic and Regulatory Diversification

Cryptocurrency projects often have different levels of adoption, regulatory acceptance, and operational focus across various geographic regions. Some projects may thrive in jurisdictions with clear regulatory frameworks, while others may face restrictions in certain markets. Understanding the geographic distribution of a project's user base, development team, and regulatory compliance can inform diversification decisions.

Correlation Analysis

While many cryptocurrencies tend to move in correlation with Bitcoin, the degree of correlation varies significantly. Some assets demonstrate independent price action based on project-specific developments, partnerships, or technological milestones. Analyzing historical correlations can help investors identify assets that may provide genuine diversification benefits rather than simply replicating Bitcoin's movements.

Risk Management Principles

Effective risk management separates successful long-term cryptocurrency investors from those who experience significant losses. Implementing disciplined risk management practices helps protect capital during market downturns while allowing participation in upside potential.

Position Sizing

Position sizing determines how much capital to allocate to each investment within a portfolio. A common approach involves allocating larger percentages to established, lower-risk assets while limiting exposure to speculative, higher-risk positions. For example, a conservative cryptocurrency portfolio might allocate 60-70% to large-cap assets, 20-30% to mid-cap projects, and 5-10% to small-cap opportunities.

The specific allocation depends on individual risk tolerance, investment timeline, and financial circumstances. Investors should never allocate more to any single position than they can afford to lose, particularly in the volatile cryptocurrency market.

Portfolio Rebalancing

Cryptocurrency prices can change dramatically over short periods, causing portfolio allocations to drift significantly from their intended targets. Regular rebalancing involves selling portions of assets that have appreciated substantially and reallocating to underweighted positions, maintaining the desired risk profile.

Rebalancing can be conducted on a time-based schedule (quarterly or annually) or when allocations deviate beyond predetermined thresholds (such as 5% or 10% from target weights). This disciplined approach forces investors to take profits from winning positions and add to positions that may be temporarily undervalued, implementing a systematic "buy low, sell high" strategy.

Security and Custody Considerations

Risk management in cryptocurrency extends beyond market risk to include security and custody risks. Investors must protect their digital assets from theft, loss, and unauthorized access. Best practices include:

- Using hardware wallets for long-term holdings rather than keeping assets on exchanges

- Implementing strong, unique passwords and two-factor authentication

- Maintaining secure backups of wallet recovery phrases in multiple physical locations

- Verifying addresses carefully before executing transactions

- Using reputable exchanges and platforms with strong security track records

The irreversible nature of blockchain transactions means that security mistakes can result in permanent loss of funds. Treating security as a fundamental component of risk management is essential for protecting portfolio value.

Evaluating Individual Cryptocurrencies

Building a quality portfolio requires the ability to evaluate individual cryptocurrencies based on fundamental factors rather than speculation or hype. A systematic evaluation framework helps investors make informed decisions about which assets deserve inclusion in their portfolios.

Technology and Innovation

Assessing the underlying technology involves understanding the project's technical architecture, consensus mechanism, scalability solutions, and security features. Questions to consider include: Does the project solve a real problem? Is the technology innovative or derivative? How does it compare to competing solutions? What are the technical risks and limitations?

Team and Development Activity

The quality and commitment of a project's development team significantly influences its long-term prospects. Researching team members' backgrounds, previous accomplishments, and ongoing involvement provides insight into execution capability. Active development, regular updates, and transparent communication indicate a healthy project, while abandoned repositories or inactive teams raise red flags.

Adoption and Network Effects

Cryptocurrency value often correlates with network adoption and usage. Metrics such as active addresses, transaction volume, developer activity, and ecosystem growth provide quantifiable measures of adoption. Projects with growing user bases, expanding partnerships, and increasing real-world utility demonstrate stronger fundamentals than those with stagnant or declining metrics.

Tokenomics and Supply Dynamics

Understanding a cryptocurrency's token economics—including total supply, circulating supply, inflation rate, and distribution mechanisms—helps assess its long-term value proposition. Projects with excessive inflation, unfair initial distributions, or unclear token utility may face downward price pressure regardless of technological merit.

Developing a Disciplined Investment Approach

Successful cryptocurrency investing requires discipline, patience, and emotional control. The market's volatility can trigger impulsive decisions driven by fear or greed, often resulting in poor outcomes. Establishing and following a systematic investment approach helps maintain consistency through market cycles.

Dollar-Cost Averaging

Dollar-cost averaging involves investing fixed amounts at regular intervals regardless of price. This strategy reduces the impact of short-term volatility and removes the pressure of timing market entries. By consistently purchasing assets over time, investors accumulate positions at various price points, potentially lowering their average cost basis compared to attempting to time a single large purchase.

Setting Clear Investment Goals

Defining specific investment objectives provides direction and helps maintain focus during market turbulence. Goals might include wealth preservation, capital appreciation, generating passive income, or participating in technological innovation. Clear objectives inform asset selection, risk tolerance, and time horizon decisions.

Investment goals should be realistic, measurable, and aligned with overall financial planning. Cryptocurrency holdings should represent an appropriate portion of total net worth based on individual circumstances, typically recommended as a small to moderate percentage for most investors given the asset class's volatility.

Continuous Learning and Adaptation

The cryptocurrency landscape evolves rapidly, with new technologies, regulations, and market dynamics emerging regularly. Successful investors commit to ongoing education, staying informed about industry developments, technological advances, and regulatory changes. This knowledge enables informed decision-making and helps identify both opportunities and risks as they develop.

Tax Considerations and Record Keeping

Cryptocurrency transactions typically have tax implications that vary by jurisdiction. In many countries, cryptocurrency is treated as property for tax purposes, meaning that sales, trades, and even certain uses of cryptocurrency can trigger taxable events. Understanding applicable tax regulations and maintaining detailed records of all transactions is essential for compliance and accurate reporting.

Investors should track purchase dates, amounts, prices, and transaction purposes for all cryptocurrency activities. Specialized cryptocurrency tax software can help organize this information and calculate tax obligations. Consulting with tax professionals familiar with cryptocurrency taxation ensures proper compliance and may identify legitimate tax optimization strategies.

Conclusion

Building a balanced cryptocurrency portfolio requires thoughtful consideration of diversification strategies, risk management principles, and individual asset evaluation. By understanding market capitalization categories, implementing sector-based diversification, practicing disciplined position sizing, and maintaining robust security practices, investors can construct portfolios aligned with their goals and risk tolerance.

The cryptocurrency market's volatility and rapid evolution demand continuous learning, emotional discipline, and systematic decision-making. While the potential for significant returns exists, so do substantial risks. Approaching cryptocurrency investment with education, preparation, and realistic expectations positions investors to navigate this dynamic market more effectively.

Success in cryptocurrency investing ultimately depends not on finding the next explosive opportunity, but on building a sustainable approach that balances opportunity with prudent risk management. By focusing on fundamentals, maintaining diversification, and adhering to disciplined investment principles, investors can participate in the digital asset revolution while protecting their financial well-being.